UK Pay Rise Alert: National Living Wage Jumps To 12.21!

Will the upcoming changes to the National Living Wage bring genuine relief to the millions of workers across the UK? The forthcoming increase to 12.21 per hour from April 2025, while welcomed, only scratches the surface of what constitutes a truly liveable wage in many parts of the country.

The United Kingdom is bracing itself for significant shifts in its employment landscape. The government has officially announced that both the National Minimum Wage (NMW) and the National Living Wage (NLW) will undergo substantial adjustments, effective from April 1st, 2025. This move is poised to impact a vast swathe of the workforce, with projections indicating that over three million workers will directly benefit from these changes. While the prospect of higher earnings is undoubtedly a positive development, it also casts a spotlight on the evolving dynamics between employers and employees.

This isn't merely a theoretical exercise in economic policy; it translates into tangible benefits for individuals. For instance, a worker currently earning the National Living Wage stands to gain as much as 1,400 annually, a considerable boost that can alleviate financial pressures and improve overall quality of life. The increase, effective from April 1, 2025, will see the National Living Wage rise to 12.21 an hour, marking a notable jump from the current rate.

- Hdhub4u Movie Updates Streaming Info Safety What You Need To Know

- Awkwafina Facts Movies More Unveiling Nora Lums Life

However, it is crucial to dissect the nuances of these changes to understand their implications fully. While the governments announcement provides a specific figure and a timeline, it's important to compare this with the "real living wage" to have a clearer understanding of the real value of the new minimum wage. Further investigation might also be done to check the real value of this for individuals across the UK.

To provide clarity on the subject, consider the following table:

| Wage Type | Current Rate (Until April 2025) | Proposed Rate (From April 2025) | Impact |

|---|---|---|---|

| National Living Wage (Workers aged 21 and over) | 11.44 per hour | 12.21 per hour | Increased earnings for over 3 million workers |

| National Minimum Wage (Apprentice Rate) | 6.40 per hour | 7.55 per hour | Supports apprentices and helps with training |

| National Minimum Wage (Workers aged 18-20) | (Figures not included in initial announcement) | 10.00 per hour | Supports young workers and those entering the workforce |

The Chancellor, Rachel Reeves, confirmed these adjustments in the Autumn Budget, signaling the governments commitment to improving the financial well-being of working individuals. The recent wage increase, is the biggest cash increase in the National Living Wage in over a decade, further emphasizes the significance of this policy shift and its potential to reshape the financial landscape for many households across the UK. This directly addresses a manifesto pledge, highlighting the government's efforts to end low pay for many working people.

- Movie Porn Guide Where To Watch Nsfw Content Latest Updates

- Ankita Dave Web Series A Deep Dive Into Her Roles Performances

The implementation of these new rates isn't without its complexities. Employers are now facing the challenge of adjusting their budgets, making sure their practices and the financial commitments can be handled, and managing potential cost increases. The rise in wages necessitates careful consideration of operational expenses, staffing models, and overall business strategies.

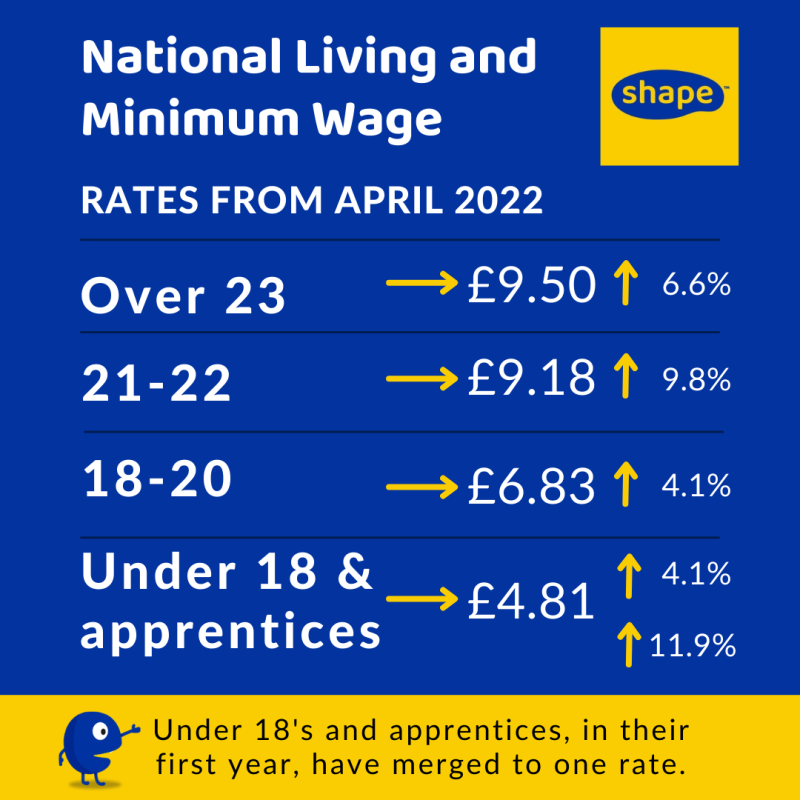

The evolution of the minimum wage in the UK showcases a gradual shift in societal attitudes toward fair compensation and workers' rights. The age threshold for the National Living Wage has progressively decreased over the years, beginning with workers aged 25 and over, then shifting to 23, and now, as of April 2024, encompassing those aged 21 and over. This demonstrates a trend of extending the benefits of the National Living Wage to an ever-broader segment of the workforce. The governments policy also extends to workers aged 21 and 22 for the first time, expanding the benefits for those who have previously been excluded.

The new National Living Wage of 12.21 per hour, however, will not fully solve the issue for workers in the UK. It is important to look at the bigger picture of economic well-being and cost of living for many individuals. The gap between the National Living Wage and the real living wage, set by the Living Wage Foundation, is crucial for many workers across the UK.

The Living Wage Foundation calculates the "real living wage" based on the actual cost of living. While any wage increase is a positive development, it's vital to grasp the difference between the statutory minimum and the voluntary, higher rates offered by many employers. For example, some nearly 16,000 UK employers are already going further by paying the higher, voluntary real living wage. Therefore, many workers will not get the desired benefits, and for many others the increase will not be as significant.

The impact is estimated to be significant, considering the increase in household incomes. This increase in wages could boost the broader economy. More income in the hands of consumers could potentially lead to increased spending, supporting business growth and the creation of new jobs. On the other hand, increased labour costs may pose challenges for some employers, potentially leading to price increases or reduced profitability.

The details on increases and pay processes will be announced soon. The government will also give further details and guidelines on how the wage increase will affect the pay processes for the different bands in the private and public sector. The announcement will offer essential insights into the practicalities of the implementation, offering a clear pathway and helping various organizations adapt.

The announcement of the National Living Wage increase is a step in the right direction. However, the economic reality and the ongoing cost-of-living crisis present a continuing challenge.

In this complex economic landscape, the 12.21 hourly rate is, arguably, a temporary measure. The real measure would be to assess its ongoing implications and make further interventions. It is about balancing economic growth with fairness. The policies should be aimed at providing sufficient pay while also protecting jobs and supporting business stability.

It is evident that the recent adjustment in wages, while welcome, will not resolve all the economic issues. The governments statutory rate of 12.21 is a positive stride towards improving the wages of many, but addressing the cost of living and the economic challenges will be crucial for creating a truly equitable economy.

Detail Author:

- Name : Marc Feil

- Username : schmeler.thaddeus

- Email : jacky09@abernathy.biz

- Birthdate : 1973-06-28

- Address : 94473 Korey Ridges East Chelsey, ID 24021

- Phone : +1.936.949.7242

- Company : Baumbach LLC

- Job : Segmental Paver

- Bio : Explicabo aperiam inventore velit soluta. Recusandae similique doloribus aut dolores non. Molestias quod maxime illo. Nihil porro nesciunt et quasi ducimus.

Socials

linkedin:

- url : https://linkedin.com/in/mitchell2992

- username : mitchell2992

- bio : Dolorum aliquam sit nobis eos ipsum.

- followers : 5537

- following : 1663

tiktok:

- url : https://tiktok.com/@mitchell.hane

- username : mitchell.hane

- bio : Suscipit officiis excepturi eos modi velit aut.

- followers : 6040

- following : 2265

instagram:

- url : https://instagram.com/mitchell5456

- username : mitchell5456

- bio : Voluptates libero illo reiciendis in voluptatem. Laudantium ab rerum rem deserunt natus et quasi.

- followers : 3452

- following : 892

twitter:

- url : https://twitter.com/mitchellhane

- username : mitchellhane

- bio : Ad ex maiores enim impedit ad velit. Laborum sed ut ex qui magni eos numquam aut. Ullam consectetur eaque non facilis beatae.

- followers : 4027

- following : 213

facebook:

- url : https://facebook.com/mitchellhane

- username : mitchellhane

- bio : Numquam sit officiis omnis ut. Ut sint qui voluptatem. Tempore ex quo quo a.

- followers : 2418

- following : 1515